Welcome to Solana’s world. Don’t know what is Solana? It’s a blockchain platform that changes how we view digital transactions and decentralized apps. Solana shines with unique features. Its speed is impressive, and it offers lower transaction costs. So, it attracts both developers and users. Are you eager to buy SOL, trade on Solana, or explore its features? This guide will provide all the essential information you need.

Introduction to Solana (SOL)

Welcome to the Solana universe! Solana is a revolutionary blockchain platform. It completely changes our view of digital transactions and decentralized apps. Solana shines with unique traits. It boasts incredible speed and reduced transaction costs. These features make it an attractive choice for developers and users alike. Are you interested in buying SOL or trading Solana? Or maybe you want to explore its features? This guide has all the essential information you need. Furthermore, you’ll learn why Solana is rising in popularity. So, discover how Solana could be the key to your crypto adventures!

What is Solana?

Solana often earns the label “Ethereum killer” because of its speedy processing times and lower costs. At its heart, Solana uses a unique consensus mechanism known as Proof of History (PoH). This approach significantly boosts its throughput. Moreover, this blockchain is not merely about cryptocurrency. Additionally, it serves as a platform for developing applications that need rapid data exchange and secure, decentralized solutions.

The Origins and Vision of Solana

Anatoly Yakovenko founded Solana. He envisioned a blockchain that could handle fast transactions without losing decentralization. Along with his team from Qualcomm, Yakovenko used his telecommunications expertise to design this new blockchain architecture. His goal was for mass adoption. Therefore, he and his team developed a unique approach to meet the growing demands of blockchain technology. This effort aimed to revolutionize how we think about blockchain efficiency and accessibility.

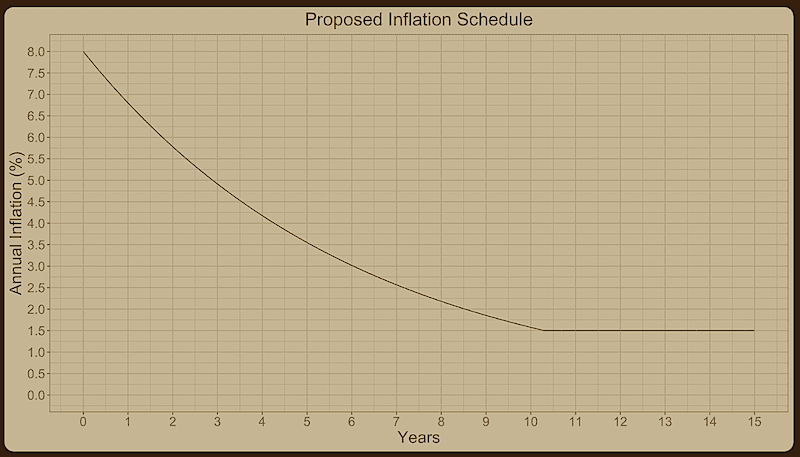

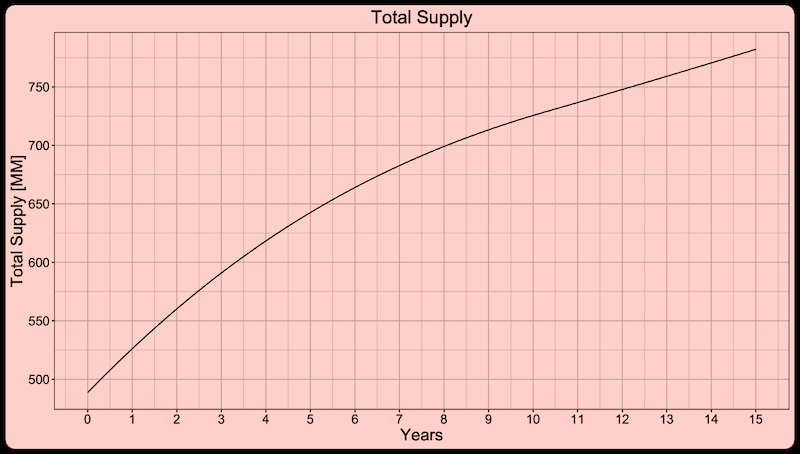

SOL’s Supply and Inflation

Understanding the circulating supply of SOL is crucial for investors and users of the Solana network. SOL tokens play a key role in operating and securing the network. They serve as a means for paying transaction fees and for staking. Therefore, the supply dynamics of SOL aim to boost participation and investment in the Solana ecosystem. Moreover, these dynamics ensure that the network remains robust and efficient.

Circulating supply

Solana’s native token, SOL, has a supply that changes with its inflation schedule. Initially, the inflation rate is 8%. However, this rate decreases yearly by 15%, so the inflation rate eventually stabilizes at 1.5%. This design balances token issuance with network growth and user incentives. Moreover, it aims to support the validator ecosystem sustainably. Additionally, it funds the Solana Foundation’s grant programs. Furthermore, it accounts for token loss and burn over time.

Inflation rate

SOL issues new tokens through inflation. The system distributes these tokens to stakeholders based on how much they have staked. Therefore, token holders and validators are motivated to help with network security and governance. Moreover, the network’s design calculates the total SOL staked. Consequently, this percentage affects the staking yields. Essentially, these yields are the returns validators and token holders receive for participation.

Total supply of SOL

This dynamic staking model pairs with the network’s inflation parameters. It aims to secure a reasonable yield for those who safeguard the network. Additionally, it supports growth in network usage. As the total supply of SOL changes, user and validator behaviors shape it. Economic incentives set by the inflation schedule also play a part. Furthermore, Solana strives to sustain a robust and engaging financial ecosystem. These mechanisms are vital. They ensure the long-term health and viability of the Solana network. Moreover, they align stakeholder incentives with network performance and security.

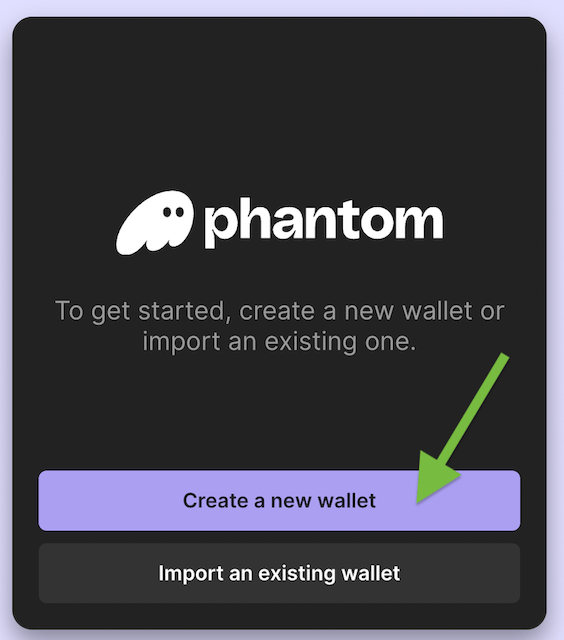

How to Create a Wallet for Solana’s Blockchain

Creating a wallet on the Solana blockchain opens doors to its dynamic ecosystem. You can trade, stake, and interact with decentralized apps. So, this section will walk you through becoming a member of the Solana community. Moreover, it will show you how to set up a wallet. We’ll use Phantom, one of the top platforms, for this process.

Search among members of Solana’s ecosystem

To start using Solana’s blockchain, you first need to pick a wallet. Make sure it supports the SOL token and integrates well with the network’s various Dapps. You’ll find a broad selection of wallets available. Each one offers different features and security measures. Therefore, it’s essential to choose one that suits your needs. Whether you value ease of use, security, or both, you have plenty of options.

How to create a wallet on Phantom?

You can easily set up a wallet on Phantom. Phantom stands out as a top wallet in the Solana ecosystem. It boasts a user-friendly interface and robust security features. First, download the app. Next, set a secure password. Moreover, remember to keep your recovery phrase safe. This phrase is vital. You’ll need it if you forget your password or have to regain access to another device. So, read below for the detailed guide on creating a wallet on Phantom.

Desktop Wallet Setup

- Download Phantom for Desktop:

- First, visit the Phantom website and select your browser.

- Second, follow the instructions to add the Phantom Wallet extension to your browser.

- Setting Up Your Desktop Wallet:

- For New Users:

- First, select “Create New Wallet”.

- Then, create a secure password.

- Enter your password and select “Continue”.

- Then, save your Secret Recovery Phrase in a secure location.

- Select “Continue” to proceed.

- For Existing Users:

- Click on “I already have a wallet.”

- Then, enter your Secret Recovery Phrase.

- Create a new password to access your wallet.

- For New Users:

- Accessing your Browser Wallet:

- Phantom is located in the top right-hand side of your browser’s toolbar.

- If not visible, click the puzzle piece icon to access browser extensions.

- Finally, click on the pin icon next to Phantom to make it visible in the extension bar.

Mobile Wallet Setup

- Download Phantom for Mobile:

- Visit the Phantom website and select your device’s app store.

- Then, follow the steps to download and install the Phantom application.

- Setting Up Phantom for Mobile:

- For New Users:

- Open the app and select “Create New Wallet”.

- Then, enable biometric security (fingerprint/facial recognition).

- Save your Secret Recovery Phrase.

- Select “Continue” to proceed.

- For Existing Users:

- Click on “I already have a wallet”.

- Enable biometric authentication (if applicable).

- Enter your Secret Recovery Phrase.

- Finally, click on “Get Started” to start using Phantom.

- For New Users:

General Tips

- Always store your Secret Recovery Phrase securely.

- Phantom team members will never ask for your Secret Recovery Phrase.

- Additionally, enable notifications for instant updates about wallet activity (Settings > Notifications).

Understanding the Solana Blockchain

Solana’s blockchain technology stands out for its amazing speed and efficiency. This section explores how the Solana blockchain works. It showcases its main features and innovations. These elements make it unique in the cryptocurrency world.

How Does the Solana Blockchain Work?

The Solana blockchain uses a special hybrid consensus model. It combines Proof of Stake (PoS) and a unique protocol, Proof of History (PoH). This combination boosts scalability and speeds up transactions. Additionally, it maintains strong security. Proof of History works as a cryptographic time-stamping tool. It ensures proper sequencing of transactions and blocks. Consequently, the network can process thousands of transactions per second. Moreover, this setup helps Solana stand out in the blockchain world.

Key Features of Solana’s Technology

Solana has a unique architecture that delivers top-notch performance. It features several key elements. Firstly, Solana uses a Proof of History mechanism. This not only ensures security but also speeds up transactions. Additionally, its innovative network structure allows for faster communication between nodes. Moreover, Solana’s architecture supports a high number of transactions per second. Hence, it stands out in the crypto world.

- Understanding Proof of History (PoH): PoH is a vital innovation. It boosts throughput and efficiency. Validators use it to record events at specific times. This step is key for keeping the blockchain consistent across all nodes.

- Solana’s Scalability and Speed: Solana can handle up to 65,000 transactions every second. This capacity shows its scalability. Moreover, this rapid processing comes from its well-designed consensus mechanisms and network setup.

- Why Solana’s Transaction Costs Are Low: Solana stands out for its low fees. Hence, transactions on its network are budget-friendly. This affordability supports various uses, from small payments to major industrial applications.

Advantages of Using Solana

Solana stands out from other blockchains with many benefits. Firstly, it offers innovative technology that gives it a competitive edge. Additionally, both developers and users enjoy numerous advantages. Moreover, Solana supports a range of real-world applications, making it highly practical.

Comparison with Other Blockchains

Solana often gets compared to top blockchains such as Ethereum. This is because it can host decentralized apps and smart contracts, just like Ethereum. However, Solana stands out due to its remarkably fast transaction speeds and reduced costs. These benefits stem from its unique Proof of History mechanism. Therefore, developers find Solana appealing. They value its quick transaction throughput and cost-effective development environment.

Benefits for Developers and Users

Solana’s open-source nature benefits developers. Additionally, its supportive community fosters innovation and collaboration. Users of the platform experience fast and affordable transactions, making it perfect for everyday use. Moreover, Solana’s scalability keeps the network efficient as it grows. This aspect is crucial, therefore, for both developers and users as the ecosystem expands.

Real-World Applications and Use Cases

Solana’s architecture caters to many applications, including decentralized finance (DeFi) and non-fungible tokens (NFTs). Moreover, it can handle a high volume of transactions cheaply. Therefore, it supports diverse use cases like micropayments, gaming, and decentralized exchanges. These applications showcase Solana’s capability to serve modern digital economies. Furthermore, they highlight its potential to spur more adoption across various sectors.

Solana’s Tokens Now Available on Tokpie

Solana has just joined the Tokpie exchange platform, opening up new trading and investment opportunities. So, let’s discover how to buy, sell, deposit, and withdraw Solana (SOL) on the Tokpie exchange.

Besides, if your crypto project runs on the Solana blockchain, you can now list token on the Tokpie exchange. As a result, the token listing on CoinMarketCap, Coingecko, and +13 other coin-trackers will go smoothly and faster.

So, this integration attracts more traders and investors and supports Solana’s growth and expansion in the crypto market.

How to Start Trading Solana Tokens on Tokpie

Getting started with trading Solana tokens on Tokpie is straightforward. Users must register for an account and deposit their tokens into their Tokpie account. As a result, users can access various Tokpie trading tools and resources to optimize their trading strategies and maximize their potential returns.

How to buy Solana (SOL)?

Now, let’s learn how to purchase SOL for USDT in three simple steps:

- First, fund your account with USDT.

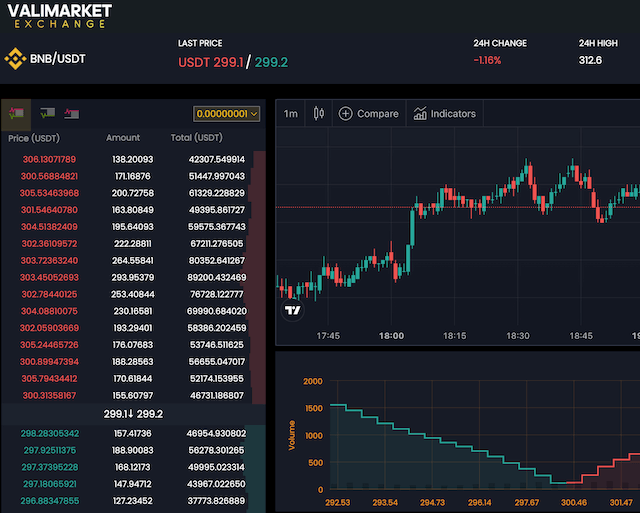

- Open the SOL/USDT market, and place your trade order to buy.

Also, learn how to place a trade order. - Withdraw SOL to your personal Solana wallet or hold on Tokpie’s account.

Buy SOL with Bank Card

In addition, you can use your bank card or Apple Pay to obtain $SOL for your local fiat currency. To do so, follow three simple steps below:

- Log in and generate the USDT (ERC20) address by clicking the [+ Deposit] button here.

- On the bank card processing page, enter the generated ERC20 address and the USDT amount, then press the “Continue” button.

- After you get a confirmation email, you can obtain the Solana (SOL) here.

How to sell Solana (SOL)?

To sell Solana (SOL) for USDT, follow three steps:

- Deposit SOL on your account.

- Open the SOL/USDT order book, and place your trade order to sell. Read the instructions if you don’t know how to place a trade order.

- Withdraw USDT to your personal wallet or hold them on your Tokpie’s account.

How to deposit Solana (SOL)?

Follow this guide to deposit Solana (SOL) on your Tokpie account at no cost. You must have a Solana-compatible wallet for SOLs depositing to your Tokpie’s account.

How to withdraw Solana (SOL)?

Use this instruction to withdraw Solana (SOL) from your Tokpie account. To withdraw Solana’s tokens, you must have a Solana-compatible wallet address. Learn how to create a Solana-compatible wallet. Also, check the withdrawal commission.

Disclaimer

Please note that Tokpie does not offer investment, legal, tax, or financial advice. Moreover, it does not guarantee token price performance or successful fundraising.

Conclusion

As we reach the end of our exploration of Solana, it’s clear that this blockchain stands as a formidable player in the crypto world, offering significant innovations that push the boundaries of what’s possible with decentralized technology.

The Future of Solana and Its Impact on the Crypto Market

Given its robust infrastructure and the increasing adoption of blockchain technology in various sectors, Solana’s potential for future growth is immense. As Solana continues to evolve, its impact on the crypto market is expected to expand, potentially leading to greater mainstream acceptance of cryptocurrencies and blockchain technology. With its ongoing development and the rollout of new features, Solana is well-positioned to remain a key contributor to the blockchain revolution.

Final Thoughts and Recommendations for Crypto Enthusiasts

Solana presents an attractive option for anyone looking to engage with blockchain technology, whether through trading, investing, or developing. Its combination of high throughput, low transaction costs, and a strong community makes it a compelling choice for crypto enthusiasts. As with any investment, conducting thorough research and considering speaking with a financial advisor is important. However, Solana’s consistent innovation and strong performance in the market make it a cryptocurrency worth watching.

By understanding and leveraging the strengths of the Solana blockchain, users and developers can fully participate in the burgeoning world of decentralized finance and beyond. Whether you’re buying SOL, trading on platforms like Tokpie, or exploring Solana’s vast ecosystem, the opportunities are as vast as they are exciting.