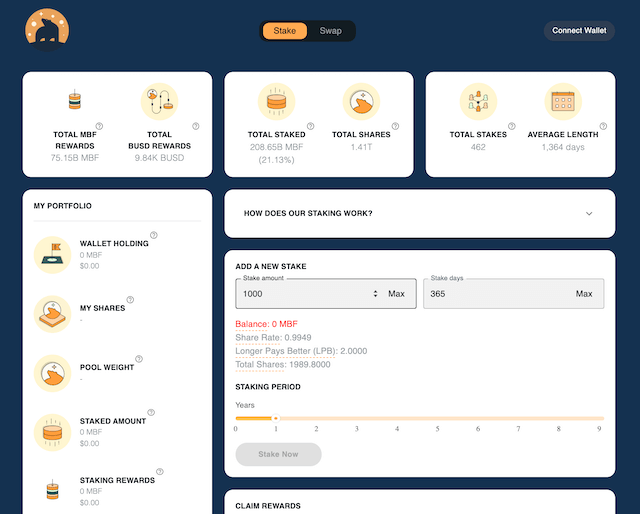

Thanks to this article, you’ll learn how to get a great return by farming popular altcoins with the TKP token on DEXs. For example, you can stake TKP tokens and BAMBOO through Binance Smart Chain on Bamboo’s DEX. As a result, you will be earning high-liquid cryptocurrency every second. Don’t be lazy and let your coins work. Start getting passive income now.

Farm BAMBOO tokens

Bamboo’s farming pool generates 57.6 BAMBOO tokens every 24 hours. So, get your revenue share by providing Bamboo (BEP20) and TKP (BEP20) on the BambooDeFi DEX. Such staking and farming give the participants up to 196% APR return. To start earning, perform the following three steps:

1. Prepare TKP and BAMBOO

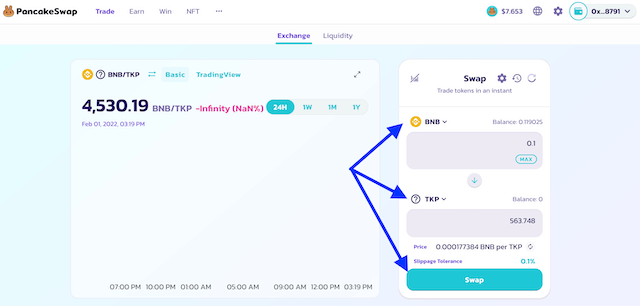

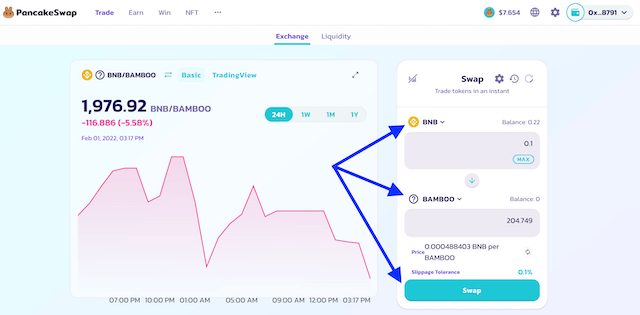

Ensure that your BEP20 wallet contains TKP and BAMBOO tokens running on Binance Smart Chain. If you don’t have them, use these PancakeSwap markets for purchasing:

Also, important to note that your wallet must have around 0.01 BNB for the gas fee payments. Find screenshots below that show the examples of acquiring BAMBOO and TKP.

2. Stake TKP+BAMBOO

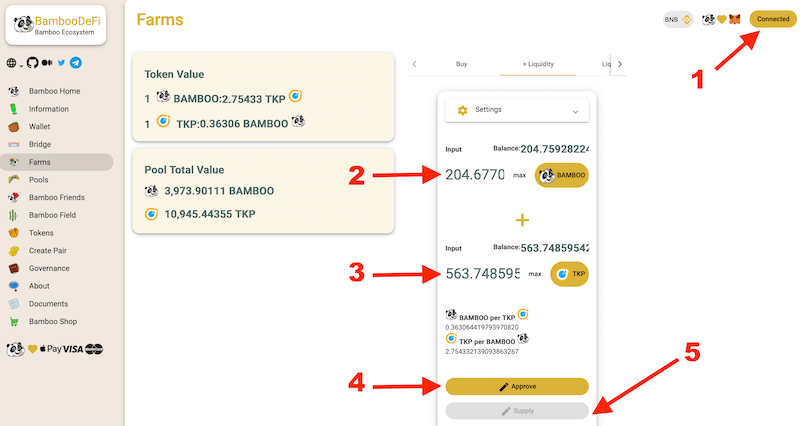

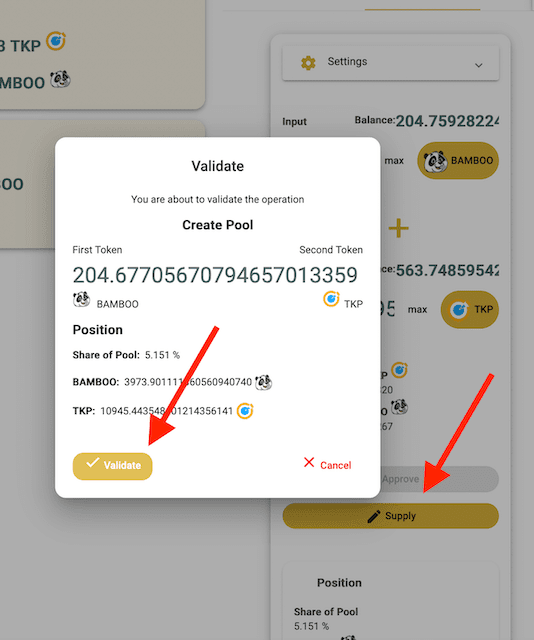

The next step is to get LP tokens by staking TKP+BAMBOO on the BambooDeFi decentralized exchange. Go to the pool page on BambooDeFi’s DEX. Then, connect your wallet (1), input BAMBOO’s amount (2), TKP’s amount (3), click on Approve button to confirm (4). Once approved, press the Supply button (5) and click on Validate.

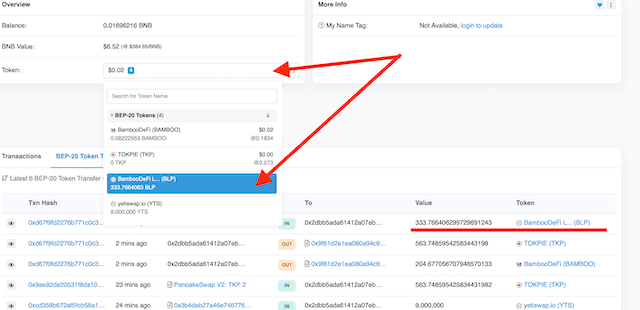

Once completed, you’ll see LP tokens on your wallet via BSCscan.

3. Start BAMBOO farming

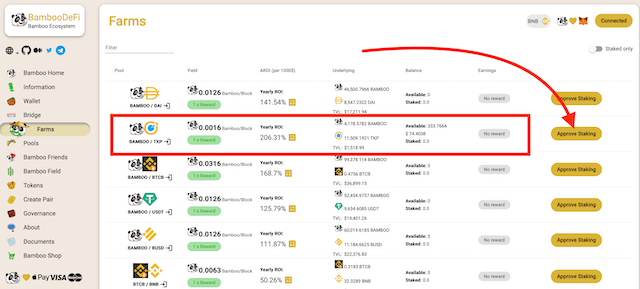

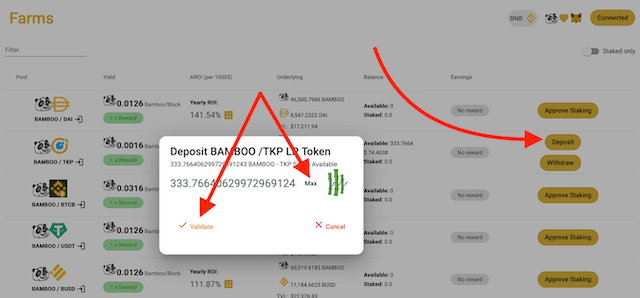

After getting LP-tokens, open the BAMBOO’s farming page, find TKP’s line and click on “Approve Staking.”

Then, confirm the operation and click on Deposit. As a result, you will see a popup window where you need to click on Max and Validate. Finally, confirm LP tokens’ staking through the wallet. That’s it. Good job!

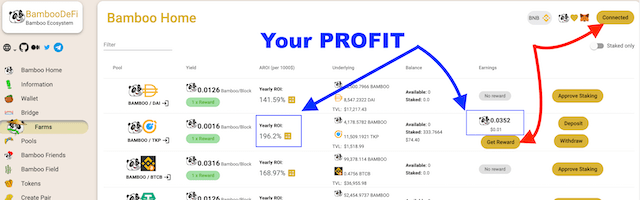

How to track BAMBOO’s earnings

Once you have done the three steps above, wait for 15 minutes. Then, track your earnings and ROI on the farming page (image below). Note that you must connect your wallet to Bamboo’s DeFi DEX to see the rewards.

How to withdraw the BAMBOO reward

Getting a reward is very simple. Open the Farm’s page, connect your wallet, press the Get Reward button, and confirm the transaction. As a result, you will receive BAMBOO coins directly on your BEP20 wallet in a few seconds. After that, you can cash out the rewards by selling BAMBOOs on any of these markets or re-investing them, as explained in this guide.

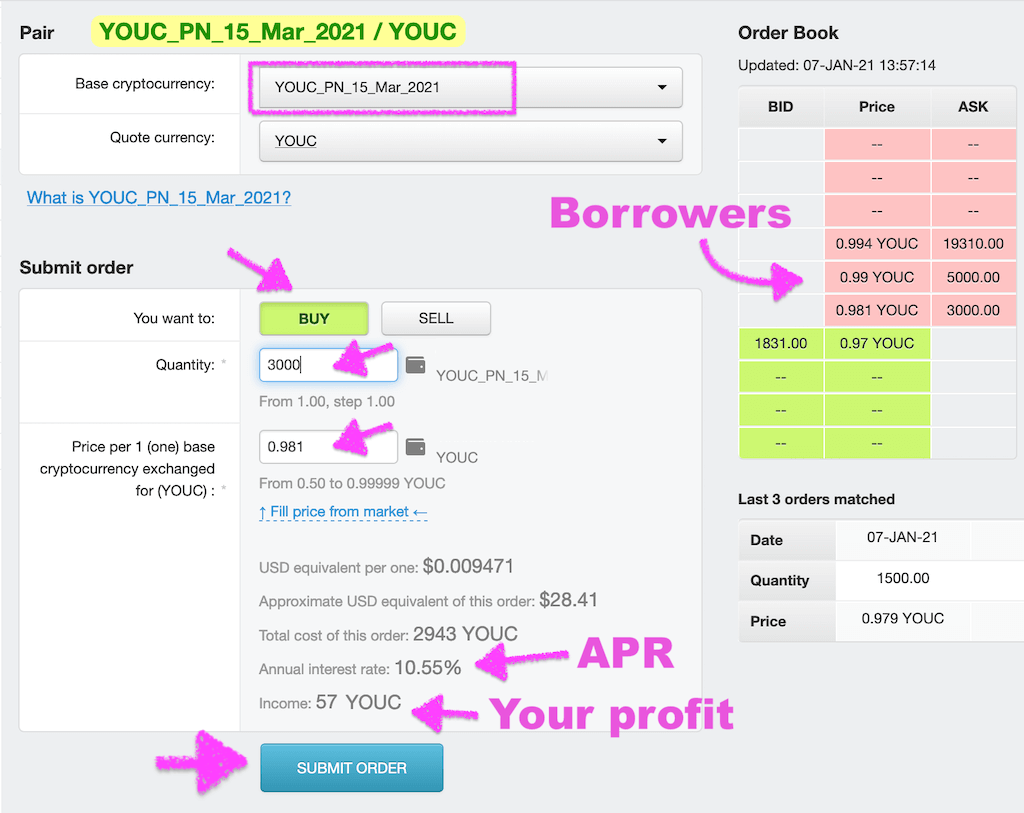

Other ways to get passive income with TKP

Additional options to obtain passive income with the help of TOKPIE tokens will appear in this article soon.