How to get the money today without cashing out your BAMBOO tokens? It’s simple. Borrow BAMBOO against your existing tokens at fair-market rates. You don’t have to pass KYC. Also, you will not face minimum amounts and penalties for early repayment.

How to Get Money Without Cashing Out BAMBOO

In the below example, Bob wants to get 137 USDT by using Bamboo tokens as collateral. So, let’s see how to earn money without losing BAMBOO tokens.

Step 1. Sign in to Tokpie exchange

Bob signs up or logs in to Tokpie.

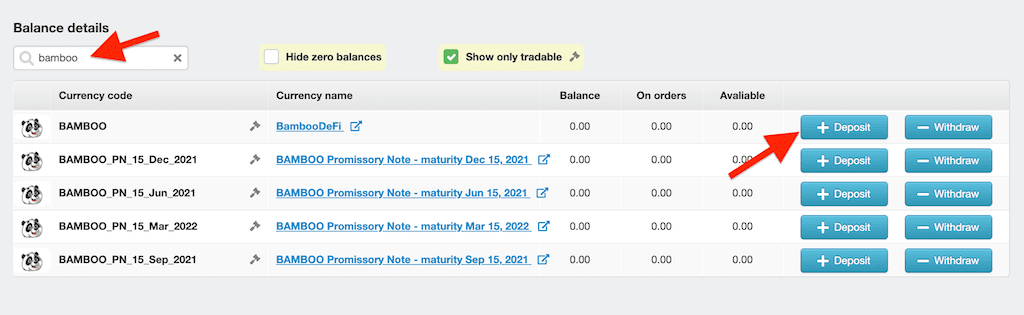

Step 2. Deposit Bamboo tokens

Bob deposits 150 Bamboo tokens. For simplicity, let’s imagine that the Bamboo token price is $1.37.

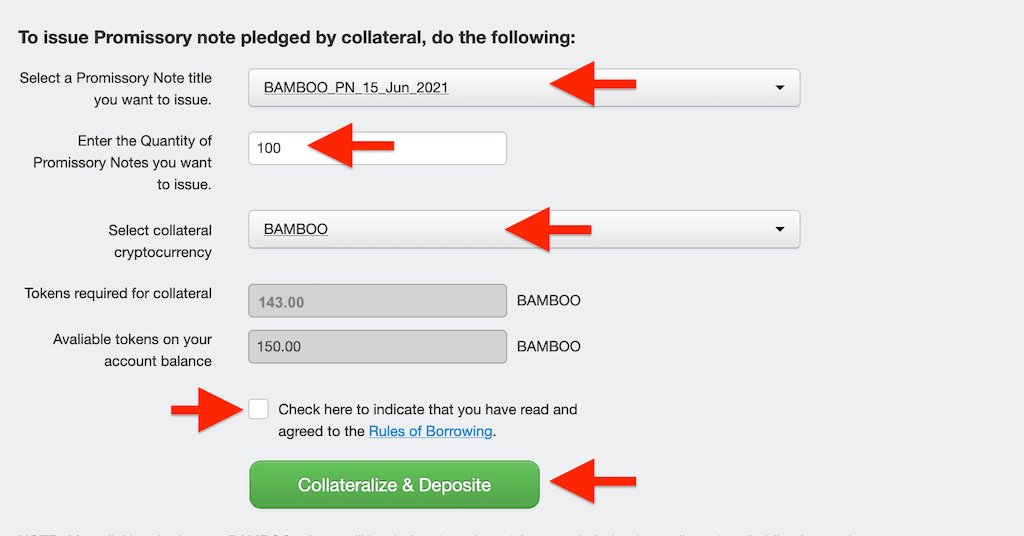

Step 3. Issue Bamboo Promissory Notes

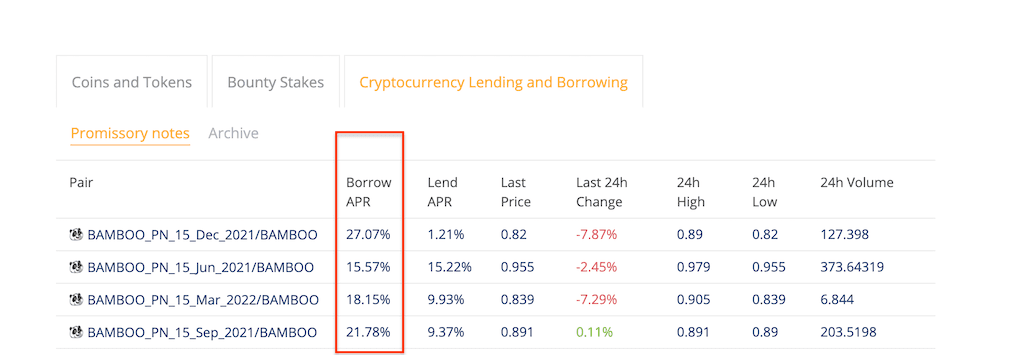

Bob opens the Borrow section and selects a Promissory note title. For example, [BAMBOO_PN_15_Jun_2021]. It means a BAMBOO token Promissory Note with June 15, 2021 maturity date. Look at the screenshot below.

Then he enters how many notes to issue. Let’s it be 100 notes. A one BAMBOO promissory note is a digital asset that gives its holder a right to get 1 BAMBOO token in the future (the future is a maturity date).

Then, he selects BAMBOO tokens as collateral cryptocurrency.

To complete the Promissory notes issuance, Bob clicks on the ‘Collateralized & Deposit’ green button. Note: Bob doesn’t get a loan when issuing Promissory Notes. It’s because he is the holder of these Promissory Notes.

After that, the BAMBOO Promissory Notes appear on his balance page. So, now Bob can sell promissory notes to get a loan.

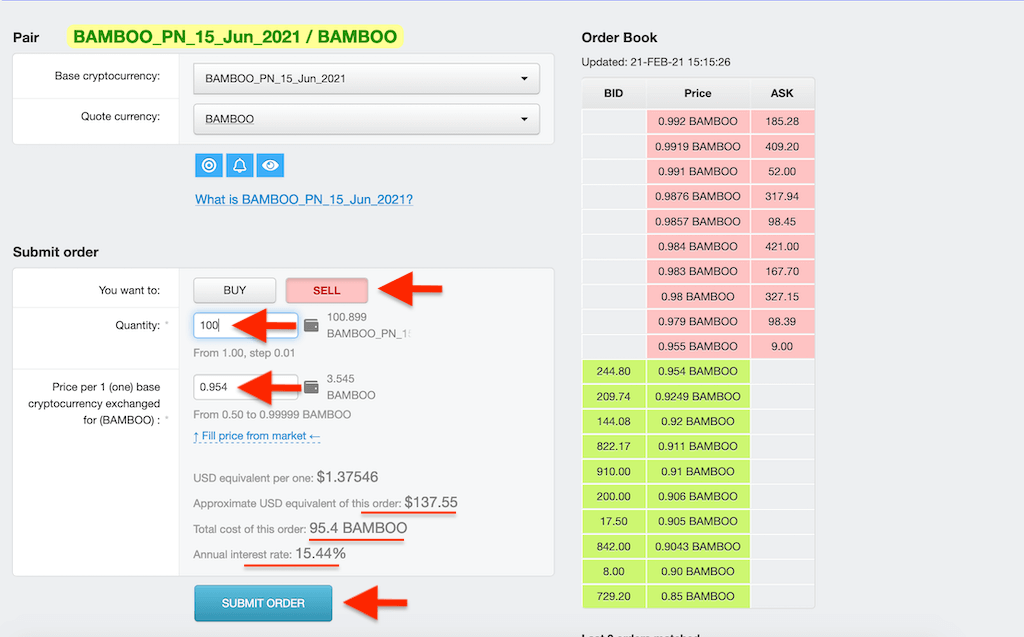

Step 4. Sell Bamboo Promissory Notes

To sell promissory notes, Bob selects BAMBOO Promissory notes by clicking on the related line here. Then he presses on the SELL button, enters quantity, price, and clicks on the SUBMIT ORDER button as shown below.

What is collateral, and how to calculate it?

A Collateral is an asset used to guaranty the repayment of Promissory Notes on the maturity date. Currently, you can use only BAMBOO tokens as collateral assets for issuing BAMBOO’s Promissory notes.

The platform calculates collateral amount automatically due to the formula:

(Quantity x Price / LTV) x 100, where

Price is a US dollar equivalent of the current highest BID of the promissory note.

Quantity is the number of promissory notes that are going to be issued.

LTV is a Loan-to-Value ratio that starts from 70% to 90%. It depends on the subscription plan.

How Can I increase Loan-to-Value (LTV)?

Tokpie users have Trial status with a 70% LTV by default. To get a higher LTV, a user can upgrade his subscription plan from Trial to the Light, Standard, Premium, or Enterprise status. Please review the plans here.

How Can I settle promissory notes before the maturity date?

Go to the Borrow section and click on the related line’s settle button (screenshot below). As a result, the exchange unlocks collateral in a few seconds.

Moreover, a user doesn’t pay any penalty for the settlement made before the maturity date (early repayment).

What if I didn’t settle Promissory Notes before the maturity date?

The exchange settles promissory notes that you didn’t pay before the maturity date automatically. For example, if you issued 100 [BAMBOO_PN_15_Jun_2021] notes, the system will take 100 BAMBOO from your collateral amount and release the rest back to your account.

What is the formula for Annual Percentage Rate (APR)?

The Annual Percentage Rate (APR) is the annual rate representing the ‘cost’ of borrowing. The formula is (1-price) / price/number of days until the promissory note maturity date x 365 x 100%.

Borrow APR is a percentage that shows the potential cost of the loan here. It’s called potential because a borrower can settle promissory notes at any time before maturity.

Shall I pay fees for BAMBOO tokens borrowing?

Yes, users pay small trading fees (0.02%-0.1%) when selling and buying promissory notes. The fee’s size depends on a user’s subscription plan.

Is it profitable to borrow BAMBOO coins?

The borrowing strategies could be very profitable. They allow users to earn profit and hedge the risks of the BAMBOO token price dump. For example, you can do the following:

- Get a BAMBOO loan when the borrow APR is low.

- Borrow BAMBOO tokens and sell them if you urgently need money.

- Sell BAMBOO promissory notes (borrow) if the BAMBOO price is going down.

- When BAMBOO overbought (price is too high), it might be better to borrow tokens instead of purchasing them directly in the spot market.

Bottom line

If you strongly believe in the BambooDeFi, but urgently need money, don’t sell your BAMBOO. Instead, borrow extra BAMBOO tokens against by using your existing BAMBOOass collateral. Therefore you will get a loan at fair-market rates — no need to pass KYC. Also, there are no minimums. Moreover, you can repay a loan at any time without penalties.

Useful links

- Learn about the BambooDeFi and how to trade its tokens.

- Check the APRs for BAMBOO’s lending and borrowing.

- Learn how to stake Bamboo tokens.

For any questions or cooperation offers, please contact Tokpie at https://t.me/tokpie.